What Is the Accounting Equation Formula?

The accounting equation is a factor in almost every aspect of your business accounting. This is how the accounting equation of Laura’s business looks like after incorporating the effects of all transactions at the end of month 1. In this example, we will see how this accounting equation will transform bookkeeping for freelancers once we consider the effects of transactions from the first month of Laura’s business. If you’re still unsure why the accounting equation just has to balance, the following example shows how the accounting equation remains in balance even after the effects of several transactions are accounted for.

To Ensure One Vote Per Person, Please Include the Following Info

Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity. An error in transaction analysis could result in incorrect financial statements. Notice that every transaction results in an equal effect to assets and liabilities plus capital. On 5 January, Sam purchases merchandise for $20,000 on credit. As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets.

Owners’ Equity

Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners. Shareholders’ equity is the total value of the company expressed in dollars. Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts. The remainder is the shareholders’ equity, which would be returned to them.

How confident are you in your long term financial plan?

By simply subtracting the costs of goods sold from revenues, you’ll determine your gross profit. The accounting equation is fundamental to the double-entry bookkeeping practice. Its applications in accountancy and economics are thus diverse.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Assets

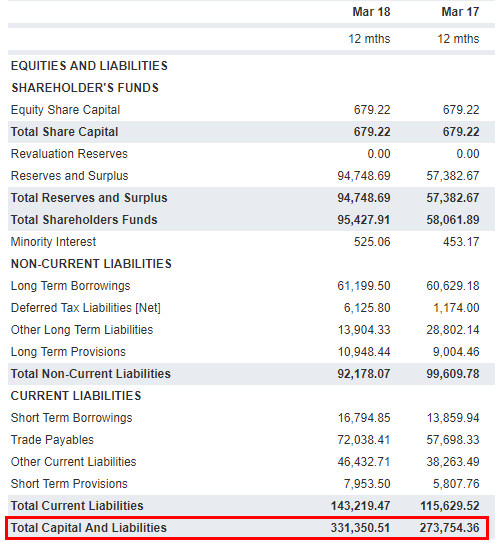

You will see how the revenues and expenses on the income statement are connected to the stockholders’ equity on the balance sheet. The accounting equation states that total assets is equal to total liabilities plus capital. This lesson presented the basic accounting equation and how it stays equal. The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved.

The 500 year-old accounting system where every transaction is recorded into at least two accounts. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The merchandise would decrease by $5,500 and owner’s equity would also decrease by the same amount. For every business, the sum of the rights to the properties is equal to the sum of properties owned.

- The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received).

- All basic accounting formulas discussed throughout this post highlight the importance of double-entry bookkeeping.

- The Accounting Equation is the foundation of double-entry accounting because it displays that all assets are financed by borrowing money or paying with the money of the business’s shareholders.

- The accounting equation’s left side represents everything a business has (assets), and the right side shows what a business owes to creditors and owners (liabilities and equity).

- In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment.

The ultimate goal of any business should be positive net income, meaning that the business is profitable. As a small business owner, you need to understand a few key accounting basics to ensure your company operates smoothly. Below, we’ll cover several accounting terms and principles you should have a firm grasp on. For a complete list, refer to our full lists of accounting terms and accounting principles. Below, we’ll cover the fundamentals of the accounting equation and the top business formulas that businesses should know.